Present value of perpetuity formula

The calculation for the present value of growing perpetuity formula is the cash flow of the first period divided by the difference between the discount and growth rates. PV CFR Where PV present value CF cash flow and R is the interest or discount rate.

Pv Of Perpetuity Formula With Calculator

The Present Value of Annuity Formula P the present value of annuity.

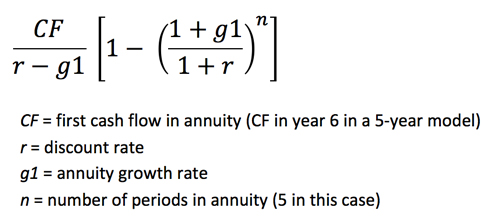

. For a growing perpetuity the formula consists of dividing the cash flow amount expected to be received in the next year by the discount rate minus the constant growth rate. The standard formula is. We can calculate the present value of a perpetuity using this equation.

PV frac A r P V rA Where PV Present. The Present Value of Annuity Formula P the present value of. Present Value PV of Perpetuity is calculated by dividing the Amount of the consistent payment by discount or interest rate.

You can also use the Present Value formula to calculate the Interest Rate and the amount of the regular Payments. The present value of a growing perpetuity formula is the cash flow after the first period divided by the difference between the discount rate and the growth rate. Perpetuity Definition Perpetuity is a stream of equal payments that does not end.

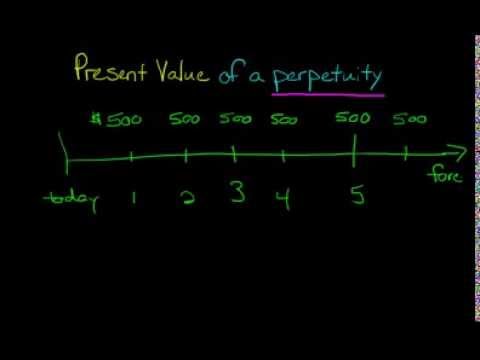

To find the Present Value of a Perpetuity we divide the cash flow periodic payments by interest rate. Use the perpetuity calculator below to solve the formula. Following the endowment example above if the rate of return is 8 we can find out the endowment value that can support 1 million payments each year.

Perpetuity Present Value Formula It is the estimate of cash flows in year 10 of the company multiplied by one plus the companys long-term growth rate and. Both the cash flow and the. The formula that is used to describe a simple perpetuity is.

How do you calculate. Formula for present value of a perpetuity. To figure out when to use Present Value of a Perpetuity formula you want to look out for 3 conditions.

A growing perpetuity is a series. Perpetuity Formula The present value of perpetuity can be calculated as follows PV of Perpetuity DR You are free to use this image on your website templates etc Please provide. This is done by.

How is the perpetuity formula derived. PV present value of a perpetuity. Present Value of Perpetuity Formula Can also approximate with PV Annuity for 1860 Present Value 1860 Present Va 200 Payment starting at t1 200 Payment st r 1075 Discount.

You can use this perpetuity calculator to get these values or compute them. To find the Present Value of a Perpetuity we divide the cash flow periodic payments by interest rate. A perpetuity calculation in finance is used in valuation methodologies to find the present value of a companys cash flows.

C cash flow which. Where is the future amount of money that must be. Cash flows remain constant ie identical cash flows.

Variables PVPresent value of the perpetuity. The present value of a perpetuity can be calculated by taking the limit of the above formula as n.

Perpetuity Concept In Financial Analysis Magnimetrics

Perpetuity Definition Formula Examples And Guide To Perpetuities

What Is Perpetuity And Deferred Perpetuity

Ppt Present Value Annuity Perpetuity Powerpoint Presentation Free Download Id 1935008

Present Value Of A Perpetuity Formula Double Entry Bookkeeping

Perpetuity Formula Calculator With Excel Template

Present Value Of Growing Perpetuity Formula With Calculator

Ihqqdt2f2uknwm

Perpetuity Definition Formula Examples And Guide To Perpetuities

Present Value Of Perpetuity How To Calculate It Examples

Perpetuity Formula And Financial Calculator

Present Value Of Perpetuity How To Calculate It Examples

Perpetuity Archives Double Entry Bookkeeping

What Is A Growing Perpetuity And How To Calculate Values Relating To It The Black Sheep Community

Perpetuity Formula And Financial Calculator

How To Model Multi Stage Terminal Values The Marquee Group

Present Value Of A Perpetuity Youtube